Support and Resistance with touches 5.0

Now it’s not an indication; it’s actually a spacecraft where you can design whatever you want as far as levels are concerned.

By reading this essay until the finish, you will understand how to make money on the market constantly.

sounds like clickbait

To achieve this, you won’t even need an indication, which is what the post is about. Nothing at all. All you will need is merely unbreakable patience. There will be numerous examples and screenshots throughout the article.

Don’t put off reading this post till later; who knows, it may be your last opportunity, and you’ll forget about it later, I know from myself.

It’s not clickbait. And given that I produce one piece once a year, I’m also definitely not a marketing fraudster. There actually is a cheat code in the marketplace, and I don’t understand why practically all individuals don’t notice it. Except for only a few individuals I know, my wife and now my mom. And I know a lot of merchants. I can imagine how I would be reading this paragraph today in your place with the words in my head: “Yes, of course, again!" since they say it on every corner. But not this time, happily for you. But you don’t have to take my word for it either, knowing how many liars there are around. Never trust anybody; always verify everything.

First, please let me give you just a little bit of history.

Perhaps I have always subconsciously wanted to achieve something more in life than just being a good trader and programmer. Some kind of recognition, perhaps. But I’m a bit of a closed person, and it’s not very easy for me to get in touch with new people. Not so long ago I even taught trading to a few people (by the way, I did not write anywhere that I can teach; they asked me personally and insistently), and it was morally very hard because I have a limit of communication, and it is not the biggest in the world. So I gave up the idea of teaching. So I’m not going to get any recognition.

So I reasoned, why not expose my strategy?

Let me repeat: for this strategy you don’t need an indicator (because I created the indicator as an assistant and nothing more), training, or anything at all. Only a chart and iron patience. I am telling my secret for free. For the sake of a couple of likes. This article will obviously be sent to each other by all people who really want to learn how to trade and want to do it stably, without any miracle indicators, without miracle zones of buyers and sellers, and who knows what else. Real, real trading.

I hope the post doesn’t reach 20 million views and the approach doesn’t cease working, but that’s improbable. Then I would simply trade the same thing, but exactly the reverse.

How it all began

I began trading back in the day when the BitMEX exchange first surfaced. In 2016 they offered open-ended futures, and that’s about the time I became exposed to trading.

But before I started trading support and resistance levels, I studied every possible and impossible strategy. I took a lot of courses and always believed that I would find the grail. But, of course, I never did. But I really wanted to be a real trader; I liked it, or maybe I just watched movies back then; who knows.

There is only one strategy that works in the market, and that strategy is mathematical expectation. I needed a strategy where the chance of winning is a multiple of the chance of losing. Where the size of a win, roughly speaking, is ten times the size of a loss. This is the only possibility to earn constantly and steadily on the market. I found this strategy after spending hundreds of hours looking at charts.

By the way, in those days I was looking at charts so frequently that I could often discern from a snapshot what cryptocurrency was being given to me. Because I had already understood the character of movement of many currencies. I guess some people are acquainted with this.

The holy grail

As you most likely may have already suspected, I will show you how to trade support and resistance levels in a specific method so that the mathematical expectation is always on your side. The secret approach to always remain in the large plus.

Why do support and resistance levels work?

And why it’s the only approach with the greatest mathematical expectation

Levels work and will always work for one simple reason: when price forms levels, the price is allocated between buyers and sellers within that range. That is the mechanics of the market. Its very essence. Because of this, support and resistance levels are formed. At the moment when who wanted to buy bought, and who wanted to sell sold, the price goes out of this range, going beyond the formed levels. And, as a consequence, there is a breakdown of stop losses and liquidation, and at the same time an organic movement to one side of the market. Therefore, there is no trading strategy that is better than this one. I will trade this market mechanics for the rest of my life, and I advise you to do the same. That taken care of, I hope.

Remember: you have to follow the plan clearly and miss 80% of the trades. There’s no other way. No other way at all.

Pareto’s Law: 20% of the work generates 80% of the outcome, while the remaining 80% of the effort gives just 20% of the result.

Now I’m trying to locate any awful level on the chart to grab a screenshot and show you, but the indicator simply happens to display only excellent levels that suit the approach. Because normally good levels have to wait, they don’t show up all the time.

Example level

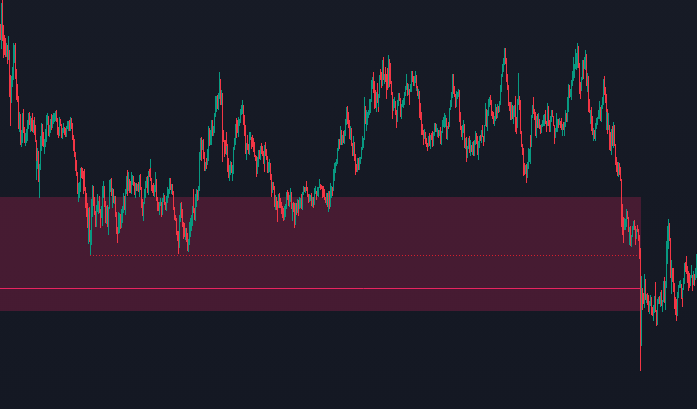

Look at this screenshot and tell me. Do you think it was worth it to make a trade here to break the level? After all, the level appears great. Answer: No! You should not have entered the deal here! Unbelievable, isn’t it?

In this particular example, the mathematical expectation is not on your side. The stop loss will be too big here, and a short stop loss will be taken out with a high probability, because while one big green candle is drawn, as you know, the price inside the candle jumps a lot. If you buy the bottom of the level, the chance of getting ten more stop losses while the price goes in your direction is maximized. And we need incredibly high odds of winning, remember?

What are the levels to trade then?

The answer is: the most gorgeous. And that, by the way, is no joke.

Let’s look at a not-so-great example:

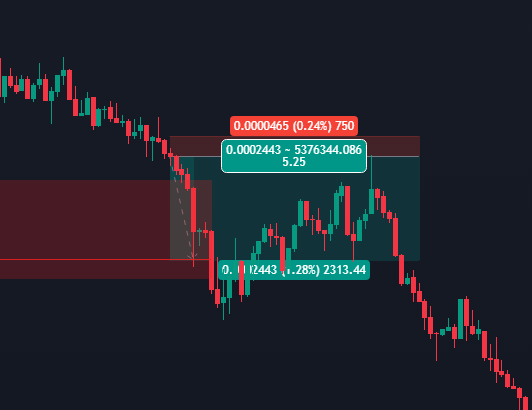

Do you notice how the price is slowly nearing the level, how the price has decreased its move? Let’s examine a little closer:

It’s like the price is flowing down to the level. And this is the best timing for a trade. And only such levels we will trade. And no other levels.

At whichever instant you discover the price stalking to the level, your risk/profit will be roughly 1 to 5 on average. Because at that moment the price is most compressed and the stop loss is quite short.

Ideally, you should have a trading terminal that knows how to show the order book correctly. There are many free ones for cryptocurrencies, but that requires a separate article/video on setup. As the price stacks up, you’ll see a major player rearranging their big sell order and thus pushing the price down in this case. And this will give you one more additional reason to enter the trade and put a stop loss behind this large bid that is being rearranged. I myself always enter a position only with limit orders and move them after the price move. So, it can happen that you put your stop loss behind my limit order, heh, and not even know it. Sometimes you’ll get knocked out by your stop loss; you can’t trade without it. But risk/profit will always be on your side, and you’ll still always stay in a nice profit. But if you trade from your phone or just don’t want to trade through a professional trading terminal, you can neglect it. It is just an additional advantage.

I also can’t help but highlight the breakout approach when you want to hold the trade longer rather than seize the momentum itself. When you have a reason to do so. There is a safe technique for it too.

The essence of it is that you should close 50% of the position on impulse (when the price shot up, the volume of the candle is huge, so we close 50% instantly; you literally have to keep your finger at the ready) and leave the rest of the position. This way your stop loss can be multiplied to close the trade at zero if the price does not go in your direction. And if it was at a global level, you would earn a lot from such a deal. And if not, you will lose nothing.

Once again regarding optimal amounts

You have to discover levels where the price is right. No other scenarios should ever be traded. You will miss 80% of your trades. And trade just 20% when all conditions are on your side. And that 20% will offer you the best win percentage. You’ll be mathematically incapable of trading at a loss.

Remember again: skip 80% of trades, trade 20% of trades. If you have problems with self-control, what helps me is this: if I have even 1% doubt in a trade, literally 1% doubt, I go in for a $1 trade (whatever minimum lot is available). It really helps the psyche. For the FOMO—you got involved in the deal, and if it went wrong, you lost nothing.

If you have problems detecting how rounded and gradually price approaches a level, you may incorporate Heikin Ashi candlesticks; some people feel this helps. Here’s an example:

Support and resistance levels can fail only in one case—it is a “bad market maker” or party. Here’s an example:controls the price in such a way that traders simply cannot earn anything here, and only he earns. There is no need to trade such a case. You will immediately notice on the chart history whether the levels are well broken. It can be seen at once and always.

How to locate nice levels without an indicator for trading

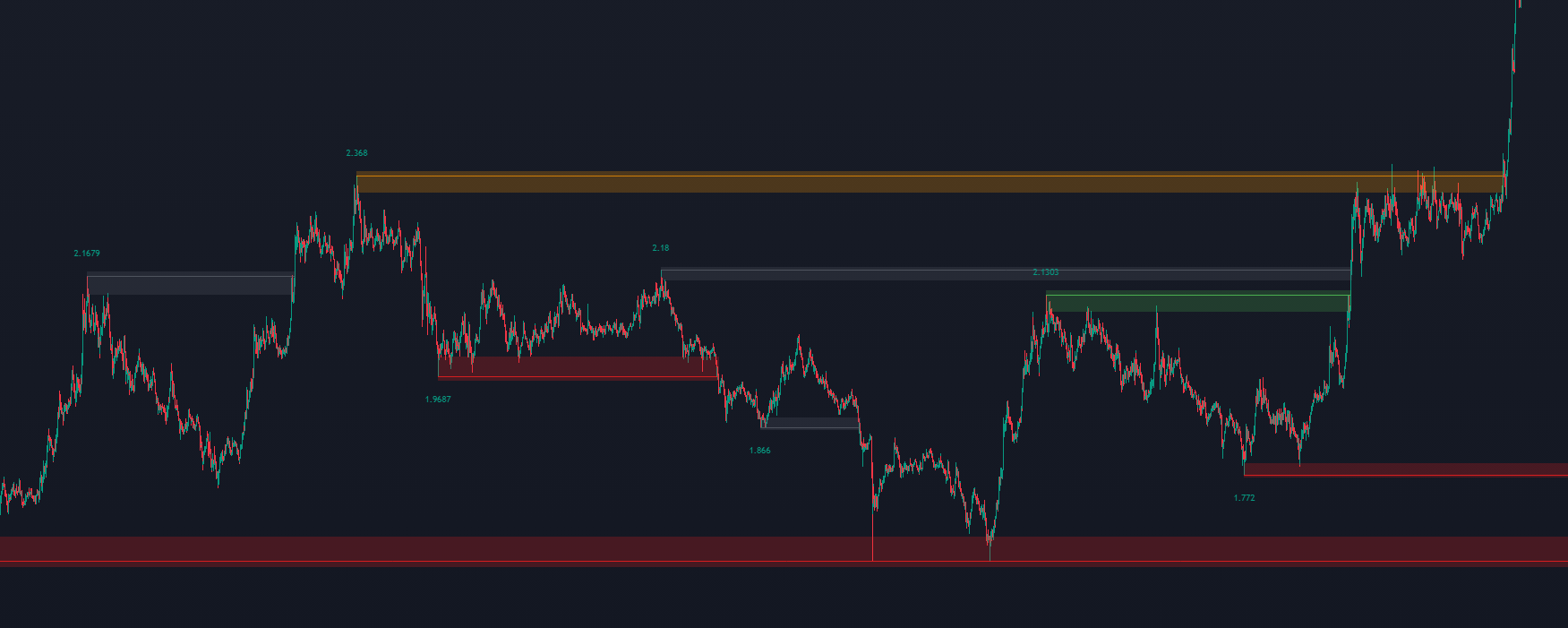

Ideally, particularly if you’re new to this method, you should be searching for global peaks. Here’s an example:

Look at that. On the left, there is nothing, nothing. That is, roughly speaking, if there were traders trading at these prices in the past, most of them closed their deals long ago. Therefore, there are the least obstacles for price movement here. Therefore, there are more chances to make money here. I could explain it in a little more detail, but it would take another whole sheet of paper. So let’s leave this short explanation.

A quick primer on money management

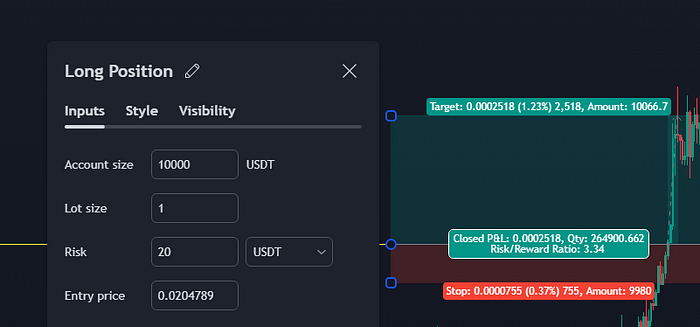

You must be sure to stick to a static stop loss. For example, the risk per trade is always $20. One coin’s price may move by 1% per minute, and another by 0.1%. You have to take that into account. You have to adjust your stop loss with the volume of the position. It is quite easy to calculate this if you use the TradingView tool:

Just input your risk on the transaction before establishing a stop loss, and the tool will show you on what volume (Qty on the chart) you need to enter so that if you receive a stop loss, then lose precisely $20.

But it might be too time-consuming, so you should write yourself a table on a sheet of paper for different % of stop loss with what amount of $ you can enter the trade. For 1% stop loss—for that amount of money, for 0.2% stop loss—for another amount of money. This will save you a lot of time, and you will enter trades at the same second. Then you will memorize this table and do it all automatically.

You must always follow this guideline. Losses must always be limited. Please trade just this method; otherwise, you will not earn money. Always one amount for probable loss.

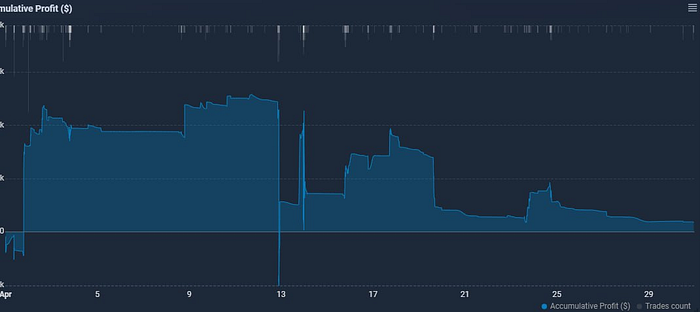

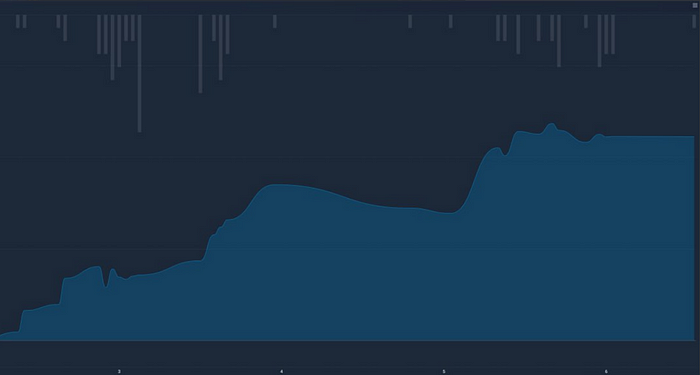

If you don’t follow this guideline, your cumulative returns will be so-so, tested again on millions of people:

And if you follow, you’ll see a cumulative profit like this:

The decision is apparent, isn’t it? Let’s pretend you’ve remembered it.

Just so you internalize precisely what excellent levels look like, here are additional examples:

Remember, we only join the trade when the price progressively approaches the level, not in a single candle.

Here the price initially soared up, broke the level; we do not make a trade on such a leap. And only after that did it start to settle down and go further. A clear stop loss emerged here, as the price began to travel quietly. This is where we may seek the entry point.

I will reveal another secret, so be it. It would seem that this level on the screenshot above does not fit; the price flew away too quickly, and where to put the stop loss is unclear. This is an hour timeframe. But in fact, if we switch to smaller timeframes, we will see how the price is slowly approaching the level there. That is, we will have a clear and small stop loss. And due to the fact that the level is hourly, we will be able to hold the trade for a long time and earn not even 1/5, but 1/20 or 1/30 risk-reward ratio if we are lucky. It depends on how long we will be in the deal.

This is how the stop loss looks if you initiate the trade on a lower period with a short stop. The price was approaching extremely slowly. 1/21.

Why I designed the indication

Support and resistance with touches 5.0 [Paul Lenosky]

I didn’t want to follow dozens of charts every day; I wanted a tool that would send me a notification when a new support or resistance level appeared. Or it would send me a notification if the price entered the level zone. So that I could spend exactly 5 seconds evaluating whether the level is suitable for trading and open a coin in the terminal if it is. So now 90% of the time I do what I want, and only 10% of the time I trade, because I no longer need to constantly monitor the appearance of new levels or the moments when the price approaches them. Indicator notifications solved this problem.

First of all, it is worth mentioning at once that the indication is not repainted; otherwise, there would be no purpose in it. If the level was drawn, it will be there and will not vanish.

Because I’m an incredible perfectionist, development took quite a while. The first versions, if I’m not mistaken, appeared back in 2019. And since then, I’ve been improving the indicator every day, rewriting it from scratch. And so until the 5th version of the indicator appeared. Current version. To make you understand, if you turn on the code profiler of one of the most popular indicators on TradingView from a popular developer, the code execution time there is 5 seconds. I was not satisfied with 2 seconds in my indicator, and until I optimized the code so that the code execution time became 1 second, I could not stop. And so it is with everything.

I tried every possible algorithm I could find for the best way to determine support and resistance levels. I even looked on the Chinese internet with a translator to look for something there, but I didn’t find any unique solutions. I tried 9999 variants of algorithms that I came up with every day for everything that is used in the indicator to settle on one in each of the algorithms. And there are a lot of them in the indicator.

I also added and enhanced what was requested by those peopleividuals, who received the indication for testing.

Initially, I planned to build an indicator that has no settings at all and everything is calculated automatically. But it turned out that people demand control. They want to modify and manage everything themselves. That’s why I placed numerous options in the settings.

Features that have been introduced to the indicator version 5.0

I will just speak about a handful of them; not all settings will make it into the review since otherwise the article would turn into a handbook. Let’s start with the easy ones:

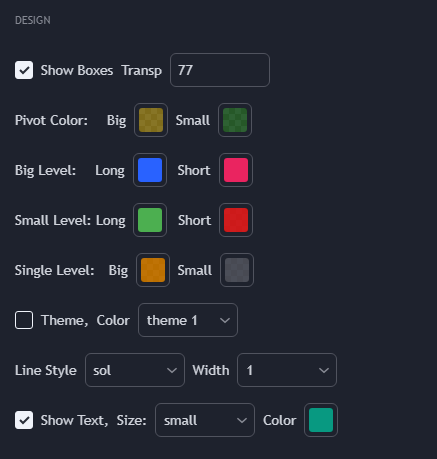

Design

Rich modification of the indicator’s look has been added:

9 color themes so you don’t have to select your own colors

The option to leave merely the lines. Or make the sections around the levels brighter or fainter.

Ability to delete pricing text from levels, alter color, size

And additional anticipated features

Additional levels

Originally, it was only possible to configure and add levels in a solitary number. For example, you modified it so that only the greatest levels were displayed. With gigantic distances that don’t even fit in the monitor.

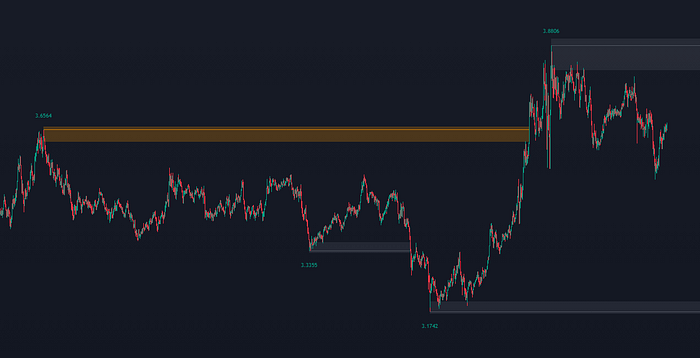

Here’s an example:

It’s set up to search just the most massive levels.

But consumers wanted to be able to scan minor levels in the same manner. Like this one, for example:

And now you may add more smaller levels independently and personalize your color and your settings for them.

Also, we didn’t want to miss levels with one single touch. But which are fantastic for trading if the price approaches the levels correctly:

Therefore, extra single touch levels have been introduced. Large single-touch levels and tiny single-touch levels may be selected independently.

The algorithms are quite clever, so if a two-touch level appears in place of a one-touch level, it will rewrite the level and change color. But only if the price has not had time to break through it, of course; otherwise, it would be a redraw. Any smaller level will be replaced by one that is larger if the small level grows into a larger one at the same price.

As a consequence, we now have the opportunity to configure and show 4 distinct sorts of levels on the chart, when previously there was just 1.

Some aspects of the levels

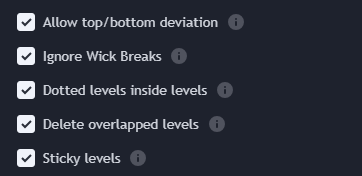

— a setting that permits the second touch to be slightly above the price of the first touch. What it looks like:

The price in this case is somewhat above the level, but not considerably. The level has not ceased to be meaningful, and then the price has progressively approached it. The border is established automatically.

— Ignore the candlestick’s shadow breakout, exactly as the name suggests. Example: output:

— Draw levels inside levels when such arise. Example: output:

Another level has surfaced within the level, which helps to notice the entrance point sooner and join the trade in time.

There are occasions when price, although remaining within a level, has developed a somewhat higher level but is still inside the present level.

The difference is quite insignificant, and the algorithm realizes that it is better to draw a more relevant level than to leave the current one on the chart. This phenomenon is so incredibly rare with the right settings that I had to look through 20 different charts before I found it. You can either leave or erase these levels. I want to make it clear that this is not a redraw, because the new level is still in the area of the previous one, because we have the setting enabled to allow the level to be broken by the shadow. If we had turned off the setting for shadow piercing, the level in this place would simply end, not become faded, and a new one would be drawn after it.

— When a new level reaches the level border, the boundary begins to correspond to this level. And so an unlimited number of times till the level is broken.

GIF animation

When a new point entered the existing level, the level border immediately adjusted to it.

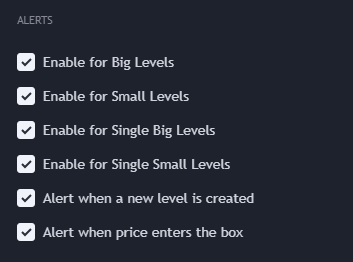

And most importantly: Alerts

It is possible to specify for which levels to set notifications and for which to deactivate them.

Ability to create an alert when a new level has emerged

Most crucially, all of these alerts are practically integrated into one. You set it up once and forget it. In the alert settings of TradingView itself, you simply need to pick “Any alert," which is a major saving on the number of alerts and enables you to follow a lot more coins at the same time. Because you don’t have to put up a separate alert for each level.

There are still a lot of things to add to the indicator in future editions, but the most important thing is that it is entirely ready. Ready to the utmost degree when my inner perfectionist is pleased and has stopped.

An indication substantially simplifies trading, since an algorithm is not a person; an algorithm cannot perceive a level where there is none. An algorithm frequently sees more than a person, particularly when you grow sleepy and start making up levels everywhere or, on the contrary, stop perceiving them.

Thanks to the indication, you can also examine the situation on the chart at the same second by scrolling through the charts one by one and without lingering on any of them. Because when you open a chart without an indication and start hunting for levels by yourself, it takes time. And you need to examine the situation on hundreds of coins.

The indicator I designed is not a panacea; it is a tool that assists a trader in his job. And helps you to save a lot of time and work.

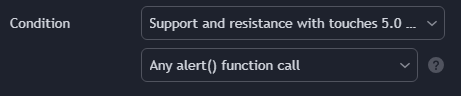

Looking at this chart, how many levels can you see?

I can only see the tallest and biggest ones at a glance. They’re quite close.

And the indicator will always see more.

Thank you very much for reading this post to the conclusion.

I truly hope that you have remembered the trading guidelines I talked about. And so you will always trade just on the positive side. I truly don’t see any reason why this shouldn’t happen following the facts I have put here. With each new deal, you will acquire experience, you will notice minor things, and your trading will become better every day. Unfortunately, all the information cannot fit in one article. And you could write a whole book full of them. I am still going to start filming my transactions on YouTube, since it is simpler and clearer to deliver information in video format. But I need more time for this. And soon, I hope, it will surface.

If you loved the post and want more like it, please leave any supporting remark below this article.

.png)